Maximizing Property Value: Strategic Upgrades for Fencing and Home Systems

Table of Contents

ToggleUnderstanding the Three Pillars of Property Valuation

Maximizing your Property Value is a common goal for homeowners. This is true everywhere, especially here in Washington State. We know it can be tough to pick the right Home Upgrades. There are many choices. These range from small changes to big system fixes. It can be hard to know where to spend your money. Our homes are big investments. Making sure they keep and grow their worth is key. This article will show you smart improvements. We will look at things like fencing and important home systems. This will help you make good choices. These choices will make your property better and last longer.

Ready to explore smarter ways to invest in your home’s future? Learn more about enhancing your property’s value or connect with our experts for personalized advice.

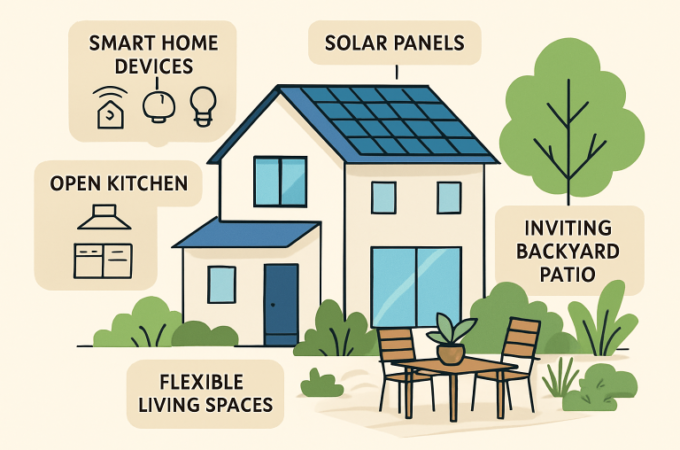

Homeownership is a significant investment, and strategic upgrades are pivotal to not only enjoying your living space but also enhancing its long-term value. From boosting curb appeal to ensuring the optimal functioning of crucial home systems, every improvement contributes to the overall worth of your property. Understanding which upgrades offer the best return on investment (ROI) is essential for making informed decisions. For instance, while a new roof might not be as visually exciting as a kitchen remodel, it often offers a substantial return by protecting the home’s structural integrity. Similarly, updating outdated systems like HVAC or electrical can prevent costly future repairs and significantly increase a home’s appeal to potential buyers. Evaluating these strategic upgrades against an infographic explaining average ROI for popular home improvements can provide a clear roadmap for maximizing your property’s potential.

When discussing property value, it’s crucial to distinguish between three distinct yet interconnected concepts: market value, assessed value, and appraised value. Each serves a different purpose and is determined through varying methodologies. Understanding these differences empowers homeowners to better comprehend their property’s worth in various contexts, whether for selling, taxation, or financing.

Market Value vs. Appraised Value

Market value represents the most probable price a property would bring in a competitive and open market under all conditions requisite to a fair sale. This assumes that the buyer and seller are acting prudently and knowledgeably, and that the price is not affected by undue stimulus. It’s a dynamic figure, constantly shifting with supply and demand, economic conditions, and local market trends. When a real estate agent conducts a Comparative Market Analysis (CMA), they are essentially estimating a property’s market value by analyzing recent sales of similar properties, current listings, and market dynamics within the neighborhood. The agent’s role here is to provide a realistic expectation of what a willing buyer might pay.

An appraised value, on the other hand, is a professional appraiser’s impartial and objective opinion of value, typically required by lenders when a property is being bought, sold, or refinanced. Unlike a market value estimate from an agent, an appraisal is a formal, detailed report conducted by a licensed professional. Appraisers use a standardized process, often relying heavily on the sales comparison approach, which involves comparing the subject property to recently sold comparable properties (“comps”). They make adjustments for differences in features, condition, age, and location. While an appraisal aims to reflect market value, it’s a snapshot in time and is often influenced by the specific lender’s requirements and the appraiser’s expertise. The market value on an assessment notice may differ from that shown on a bank mortgage appraisal or a real estate appraisal because an assessment reflects the value as of a specific past date (e.g., July 1 of the previous year), while a private appraisal can be done at any time, reflecting current market forces.

The Role of Assessed Value in Property Value and Taxes

The assessed value is primarily a municipal or county government’s valuation of a property for the purpose of calculating property taxes. This value is determined by the local assessor’s office and is typically a percentage of the property’s market value, as defined by local statutes. For instance, residential properties in some regions are assessed as of January 1st of the current year, using three to five years of prior sales information.

Assessors often employ a method called “mass appraisal,” which involves analyzing real estate market trends based on location and characteristics to estimate fair market value for large numbers of properties simultaneously. This approach detects local trends rather than appraising each property individually. For example, in Cook County, properties are valued once every three years. The assessed valuation determines an individual’s share of the total taxes collected by local taxing bodies.

The assessed value may not always align perfectly with the current market value or an appraised value. This discrepancy can arise due to the infrequent assessment cycles or the mass appraisal methodology. Property owners have the right to challenge their assessed valuation by filing an appeal with the assessor’s office during specific periods. These appeals can often be filed for free, and assistance is available from taxpayer services departments.

Key Factors That Drive Your Property Value

Numerous elements converge to determine a property’s worth, influencing everything from its initial listing price to its long-term investment potential. Understanding these factors is crucial for homeowners looking to protect or improve their investment.

- Location: This remains the paramount factor. Proximity to good schools, employment centers, amenities (parks, shopping, restaurants), and transportation hubs significantly boosts value. Neighborhood safety and desirability also play a critical role.

- Neighborhood Trends: The overall health and direction of the local real estate market, including recent sales, new developments, and community improvements, directly impact individual property values.

- Property Size and Layout: Both the square footage of the home and the size of the lot contribute. Functional layouts, open-concept designs, and the number of bedrooms and bathrooms are often highly sought after.

- Age and Condition: While older homes can have charm, newer construction or well-maintained older properties typically command higher values. The condition of major systems (roof, HVAC, plumbing, electrical) and overall upkeep are vital.

- Market Conditions: Whether it’s a seller’s market (more buyers than homes) or a buyer’s market (more homes than buyers) dramatically affects values. In a seller’s market, your home’s value is likely to go up due to increased demand and limited supply. Conversely, in a buyer’s market, your home value may decrease.

How Renovations Impact Your Property Value

Home improvements are a common strategy to increase property value, but not all renovations offer the same return on investment (ROI). Strategic upgrades that improve functionality, modernize aesthetics, or improve energy efficiency tend to be the most impactful.

Exterior updates, such as a new roof, siding, or a freshly painted facade, significantly boost curb appeal—the first impression a property makes. These improvements not only make a home more attractive but also signal good maintenance to potential buyers. Interior renovations, like kitchen and bathroom remodels, often yield high ROI because these spaces are central to daily living and highly scrutinized by buyers. Updates that improve energy efficiency, such as new windows or upgraded insulation, can also increase value by lowering utility costs.

When making improvements, it’s beneficial to update your home’s facts on online estimators. While these tools may not automatically reflect every change, providing accurate information can help improve the accuracy of your home’s estimated value. Well-executed renovations increase buyer demand, allowing you to command a higher sale price.

Boosting Curb Appeal and Security with Strategic Fencing

A well-chosen and professionally installed fence does more than just mark property lines; it significantly contributes to a home’s curb appeal, security, and overall livability. Fencing creates a defined boundary, offering a sense of privacy and seclusion from neighbors and street noise. It also improves security, acting as a deterrent to unwanted visitors and providing a safe enclosure for children and pets.

First impressions are crucial in real estate, and a stylish, well-maintained fence can dramatically lift a home’s exterior aesthetic. It can complement the architectural style of your house, add visual interest, and contribute to a cohesive landscape design. Investing in a professionally installed Washington Fence Property Value adds both aesthetic and functional benefits, making your property more appealing and secure.

Choosing the Right Fencing Materials

The choice of fencing material should align with your aesthetic preferences, functional needs, maintenance tolerance, and local regulations.

- Wood fencing offers a classic, natural look and can be customized in various styles, from picket to privacy. It provides excellent privacy and can be stained or painted to match your home. However, wood requires regular maintenance, including sealing, staining, or painting, to prevent rot, warping, and insect damage.

- Vinyl fencing is a popular low-maintenance option that comes in many styles and colors, often mimicking the look of wood without the upkeep. It’s durable, resistant to rot and pests, and typically only requires occasional cleaning.

- Aluminum fencing is an neat choice, often used for decorative purposes or to enclose pools. It’s highly durable, rust-resistant, and requires very little maintenance. While it offers security, it doesn’t provide privacy unless combined with other materials.

- Chain-link fencing is the most economical and practical option for securing large areas, especially for pets. While not as aesthetically pleasing as other options, it’s extremely durable and requires minimal maintenance.

Always check with your local municipality for any zoning ordinances or homeowner association rules regarding fence height, materials, and placement before installation.

Enhancing Livability and Efficiency with Home System Upgrades

Beyond aesthetics, the core functional systems of your home play a critical role in its livability, safety, and long-term value. Upgrading these systems—including HVAC, plumbing, and electrical—ensures safety and reliability, improves energy efficiency, and modernizes your property to meet contemporary standards. These improvements are often less visible than a new kitchen, but they are foundational to a comfortable and functional home, making them highly attractive to discerning buyers.

Ensuring your home’s core systems are up-to-date is crucial for Home comfort property value. Old, inefficient, or unsafe systems can be major liabilities, leading to high utility bills, frequent breakdowns, and even safety hazards. Modernizing these systems not only mitigates these risks but also improves the daily comfort and convenience for residents.

Upgrading Your HVAC and Electrical Systems

HVAC Systems: An aging heating, ventilation, and air conditioning (HVAC) system can be a significant drain on energy and a source of discomfort. Older units are often inefficient, leading to higher utility bills and inconsistent indoor temperatures. Upgrading to a modern, energy-efficient HVAC system can dramatically reduce energy consumption, improve indoor air quality, and provide more reliable heating and cooling. If you have a finished basement, extending your existing HVAC system to this area can transform it into a truly comfortable and usable living space. However, it’s crucial to have a professional assess whether your current unit has the capacity to handle the additional load. If not, a dedicated system or a more powerful upgrade might be necessary.

Electrical Systems: An outdated electrical system poses both inconvenience and significant safety risks. Signs you might need an electrical upgrade include dimming lights when appliances are used, frequently tripping circuit breakers, warm outlets or switch plates, and a burning smell. These indicators suggest an overloaded system, faulty wiring, or an electrical panel that can no longer meet your home’s demands. Older homes, in particular, may have wiring that isn’t equipped for the multitude of modern electronics and appliances we use today. Upgrading your electrical panel capacity and wiring not only prevents potential fire hazards but also ensures a stable and reliable power supply throughout your home. It’s an investment in safety that also significantly boosts a property’s value and appeal. Consistent, unexplained increases or spikes in utility costs can also signal that your electrical system needs an update.

Measuring the Impact: From Online Tools to Professional Appraisals

Once you’ve made strategic improvements to your property, it’s natural to want to understand their impact on your home’s value. Various tools and methods are available to help you track your investment, each offering different levels of accuracy and detail.

Online Home Value Estimators

Online home value estimators, often referred to as Automated Valuation Models (AVMs), are popular tools that provide instant, free estimates of a property’s worth. These platforms, such as Zillow’s Zestimate or Redfin’s Estimate, work by employing proprietary formulas that combine vast amounts of public and user-submitted data. This data includes details about the home (bedrooms, bathrooms, age, square footage), location, property tax assessment information, and sales histories of the subject home and recently sold properties in the area.

While incredibly convenient, it’s important to understand their limitations. These estimators are a good starting point for valuation but are not official appraisals. Their accuracy can vary significantly depending on the location and the availability of data. For example, the Zestimate’s median error rate for on-market homes nationwide is 1.83%, while for off-market homes, it’s 7.01%. This means that while they can be quite close for actively listed properties, they are less reliable for homes not currently on the market. They may also struggle to account for unique features, recent renovations, or specific property conditions that haven’t been digitally recorded. To improve their accuracy, homeowners can often update their home’s facts and photos on these platforms.

The Professional Approach: CMAs and Appraisals

For a more precise and reliable valuation, especially when buying, selling, or refinancing, a professional approach is indispensable.

A Comparative Market Analysis (CMA) is typically performed by a real estate agent. It’s a detailed report that analyzes recent sales of comparable properties, current listings, and expired listings in your area to determine a competitive selling price range. Agents use their local market expertise and access to the Multiple Listing Service (MLS) to provide a nuanced perspective that online estimators often miss. While not an appraisal, a CMA offers a valuable insight into market value from a sales perspective.

A professional appraisal is the most authoritative valuation method. Conducted by a licensed appraiser, it involves an in-person inspection of the property, during which the appraiser evaluates its condition, features, size, and any improvements. They also consider the property’s location, local market conditions, and recent sales of comparable properties. The appraiser then compiles a detailed report, which includes their expert opinion of the property’s market value. Key components of an appraisal typically include an evaluation of the site, a description of the improvements, an analysis of the local market, and the application of valuation approaches (most commonly the sales comparison approach). Appraisals are crucial for securing financing, as lenders rely on them to ensure the property’s value supports the loan amount.

Frequently Asked Questions about Home Valuation

Understanding the nuances of property valuation can be complex. Here, we address some common questions that homeowners often have.

How often do property values change?

Property values are in a constant state of flux, influenced by a myriad of economic, social, and local market factors. In healthy, sustainable markets, home values typically increase over time, growing by an average of 3-4% each year. However, this is an average, and actual changes can be much more dynamic.

Short-term fluctuations are common and can be driven by local conditions such as the amount of inventory available, the intensity of bidding wars, interest rate changes, or broader economic shifts. For example, a sudden influx of buyers in a low-inventory area can lead to rapid appreciation, while an increase in available homes or an economic downturn might cause values to stagnate or even decline. Online estimators like Zillow update their Zestimates regularly to reflect these fluctuating values, making them useful resources for tracking short-term changes.

Can a home’s value decrease?

Yes, a home’s value can certainly decrease. While properties generally appreciate over the long term, several factors can lead to depreciation.

- Poor condition and lack of maintenance: Neglecting repairs, allowing systems to become outdated, or failing to maintain the property’s aesthetic appeal can significantly reduce its value.

- Undesirable location changes:Changes in the surrounding neighborhood, such as increased crime rates, declining school quality, or the development of undesirable commercial properties nearby, can negatively impact property values.

- Economic downturns: Broader economic recessions, job losses, or rising interest rates can reduce buyer demand and affordability, leading to a decline in home values across the market.

- Buyer’s markets: In a buyer’s market, where there are more homes for sale than active buyers, sellers often have to lower their prices to attract offers, leading to a general decrease in values.

- Property-specific issues: Factors like structural problems, environmental hazards, or significant functional obsolescence (e.g., an outdated layout that’s difficult to modify) can also cause a home’s value to depreciate.

What is the difference between an assessment and an appraisal?

The terms “assessment” and “appraisal” are often used interchangeably, but they refer to distinct processes with different purposes and methodologies.

An assessment is primarily conducted for property tax purposes. It is performed by a government assessor (e.g., a county or municipal assessor’s office) to determine the taxable value of a property. Assessors typically use mass appraisal techniques, evaluating large numbers of properties at once based on general characteristics, recent sales data in the area, and market trends. The assessed value is usually a percentage of the property’s estimated market value, as mandated by local tax laws. The goal is to ensure a fair and equitable distribution of the property tax burden across all properties within a jurisdiction. Property owners receive an assessment notice, which they can typically appeal if they believe the valuation is inaccurate.

An appraisal, conversely, is a professional opinion of a property’s market value at a specific point in time, usually conducted for a real estate transaction, such as a purchase, sale, or refinance. Appraisals are performed by licensed, independent appraisers who conduct a thorough, in-person inspection of the specific property. They analyze its unique features, condition, size, and amenities, and compare it to recently sold comparable properties. The appraisal report is a detailed document used by lenders to ensure that the property’s value supports the loan amount, protecting their investment. Unlike assessments, appraisals are highly individualized and reflect the current market conditions more precisely.

Conclusion

Maximizing your property’s value is a continuous journey that involves thoughtful planning and strategic investment. We’ve explored how understanding the different types of property valuation—market, assessed, and appraised—provides a foundational perspective for homeowners. From there, identifying key drivers such as location, neighborhood trends, and market conditions helps to frame where your property stands.

Strategic upgrades, particularly those that improve curb appeal through quality fencing and improve the livability and efficiency of home systems like HVAC and electrical, offer significant returns. These improvements not only make your home more enjoyable but also position it favorably in the market. Investing in a robust fence improves security and aesthetic appeal, while ensuring your home’s core systems are modern and efficient guarantees comfort, safety, and lower operating costs.

Finally, utilizing both online estimation tools as a starting point and professional CMAs and appraisals for precise valuations allows you to effectively measure the impact of your investments. Regular maintenance and proactive upgrades are not just expenses; they are vital components of a long-term investment strategy that protects and grows your most valuable asset. By assessing your property’s needs and upgrading strategically, you can ensure your home remains a comfortable haven and a sound financial asset for years to come.